As a fellow small business owner, I am feeling the economic impact of the COVID-19 “Coronavirus” global pandemic just as each of you are. I am facing many of the same questions and concerns as well: When can our staff return to work? How can we continue to make payroll and cover operating expenses while income is down – or completely gone? How long will this all last, and how can we make up for these losses quickly once it does come to an end? That’s why I created this recovery guide specifically to share actionable resources to assist you in answering and overcoming those questions and to provide hope. We want to remind you that your business is not alone in these struggles and other small businesses may be able to come together and help each other through this challenge that we are all facing.

But before we delve into the specific and unique challenges we now face, and how to adapt to them and overcome, I’d like to share some historical perspective and current feedback from legendary entrepreneurs and investors so that we may learn from their wisdom and experience:

Warren Buffett

Warren Buffett

Widely considered to be the top investor of all time. Over his 54-year tenure at Berkshire Hathaway, Buffett has generated 20.5% annualized returns for shareholders — more than double the rate of return achieved by the S&P 500. To put this in perspective, consider that a $1,000 investment in Berkshire when Buffett took the reins would have been worth a staggering $24.7 million today. (1)

As such, his economic advice carries significant weight, and here are some things he has said about how to operate and invest during down-markets such as the one we are in the midst of at present:

"Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble."

"Widespread fear is your friend as an investor because it serves up bargain purchases."

"We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful."

"The best chance to deploy capital is when things are going down."

So, what do those quotes mean to you as a small business practice owner? Well, your competitors are probably just as afraid as you are right now, maybe even more. They are likely pulling in the reins on all spending, including advertising and purchases. This creates two great specific opportunities for you:

- With less being spent on advertising, and more people home consuming media, you can be a bigger fish in a smaller pond and gain local market share while your competitors recoil.

- Both sellers of products, and financiers of purchases, are handing out great deals right now!

Fewer people are buying, so prices are dropping on non-emergency goods, and with less buying, there is less financing taking place. Backed by a 0%-0.25% Federal Interest rate, you can refinance existing equipment and loans, or acquire new ones at record low costs. (2)

Forbes Magazine

During the great housing-bubble and financial crisis of 2008, that I still remember all too well, Forbes wrote a great article about why advertising during a recession is a necessity. This advice is very applicable to our current situation at hand, and I highly recommend you take a few minutes to read the article here.

I hope these quotes and that article make you feel a little better and more confident about your business’ long term prospects. While it’s impossible to ignore the immediate hardship we all face from this truly unique and first time ever global economic shutdown caused by the COVID-19 virus and its pandemic fallout, we can hold faith in the fact that our economy and that of the world, have crashed before and everyone reading this newsletter has survived at least two major economic crises in their lifetime, the terror attack of 9/11, and the great recession in 2008. Hopefully, in the next few weeks, we will all be able to say we survived the Coronavirus crash as well!

With that said the remainder of this newsletter will highlight a few resources we have compiled that may be able to help your business survive and thrive through this crisis and beyond!

The COVID-19 (Coronavirus) Healthcare Clinic Business Survival & Recovery Guide:

Equipment Financing and Loan Resources

With fewer businesses investing in capital equipment, and fewer loans to write thereto, at a time when our Federal Reserve has lowered interest rates to ZERO the best time to invest in equipment or capital for your business may be right now! With that in mind, we have been able to identify a couple of unique financing programs that can give you access to new equipment, technology, and capital today without incurring the overhead associated until tomorrow…

The 12 -Month STEP Program

If you have been considering adding an imaging device such as a fluoroscope, or digital x-ray, laboratory equipment to process autologous regenerative medicine, or even an Ozone generator to harness Ozone’s anti-viral properties or any other medical devices or technology for that matter – this program may be right for you!

What if I told you that you could finance $140,000 of equipment for only $5,094 in year-one? Wouldn’t the revenue from providing those new services far exceed the expense? Well, that’s exactly what you can do today with this new financing program. Just click here to download the details and apply today!

- Months 1-6 only $99

- Months 6-9 only $500

- Months 9-12 only $1,000

- Months 13-60 your normal monthly payment (avg. $3,700 on $140,000 purchase)

There are no pre-payment penalties at payoff after the 24th month. This program allows the customer to have low payments for one year and by then the equipment is likely to have paid for itself!

A/R Factoring

As we are currently in the 2nd week of “social distancing” and partial shut-down in most areas of the country, you may only require short-term capital to cover payroll and other expenses at this time. As such, a great potential solution is accounts receivable factoring, in which your current unpaid medical claims can be leveraged as collateral for a loan at very low-interest rates.

While I have utilized many factoring companies in the past, Alleon Healthcare offers a high rate of initial payment, with very low monthly interest that could be just right for the situation at hand with COVID19. Upon application and approval, you will be paid up to 80% of the A/R currently outstanding that you submit. Once paid by the 3rd party insurance company, the remaining balance of 20% will be paid to you, minus a 2% monthly financing fee. For example:

You submit a claim to Alleon Healthcare that is estimated to collect $100. Within 24 hours they will advance you $80 (80% advance rate) on this claim. If the claim is paid by the insurance provider within 30 days, Alleon will be entitled to their advance ($80), plus their factor fee (2% of $100 = $2.00), and will send the remainder ($23) to you.

To learn more about A/R factoring with Alleon Healthcare download their fact sheet click here. To apply for A/R factoring with Alleon Healthcare complete their application click here.

Small Business Interruption Loan

Small Business Interruption Loan

If you find yourself in a negative cash flow situation due to the current global economic slowdown and stay-at-home orders and you need a larger amount of working capital for a longer period of time, the Federal government has deployed resources to assist US businesses through the “Families First Coronavirus Response Act”. (3)

Among these resources is the SBA’s Economic Injury Disaster Loan program which provides small businesses with working capital loans of up to $2 million under the small business act. Loans could be used for payroll support, including paid sick, medical, or family leave, and costs related to the continuation of group health care benefits, employee salaries, mortgage/rent payments, utilities and more. Loans used to cover payroll could be forgiven if businesses retain employees through June 30, 2020. For more details and to apply please visit this page.

Digital Marketing

With many “stay-at-home” orders and the majority of workers and students telecommuting, there has never been a time when more Americans are in front of internet-connected devices than right now! This is the perfect time to reach a broader audience that under normal circumstances may not have ever seen your message.

With many “stay-at-home” orders and the majority of workers and students telecommuting, there has never been a time when more Americans are in front of internet-connected devices than right now! This is the perfect time to reach a broader audience that under normal circumstances may not have ever seen your message.

Additionally, with decreased competition, your ad spend will go further and you can capture local market share from your competitors while they pull-back advertising efforts out of fear. We have secured additional support and special offers from a number of digital marketing vendors to aide our clients during this unprecedented time as follows:

Renegade Marketing

This firm utilizes a unique approach leveraging site traffic from your top local competitors, targeting their visitors across other digital platforms such as Facebook and YouTube, and placing your clinic’s messaging in front of them! In this fashion, they solicit “buyers”, actual web traffic that was shopping to see another provider for a similar service locally. Additionally, a web-based portal is provided that communicates with the potential leads using AI technology and facilitating a warm hand-off to your staff for follow-up and booking. In addition to their typical campaigns for physical and regenerative medicine, they have developed a line of advertisements based upon immune system support and viral load mitigation that ties into the standard services our facilities typically offer. Watch this video to learn more by clicking here.

FREE TRIAL OFFER – The 1st month’s service charge will be waived. Just provide your advertising spend budget and experience firsthand if this service will work for your practice.

To get started simply email Dean Hawe at: apply@renegademarketing.net

RC Digital

While this firm typically specializes in filling live new patient workshop presentations, they have developed a very unique webinar-based approach to supplement or replace live events until normal societal order returns. In addition, they are temporarily waiving their ad management fees and also offering complimentary one-hour initial website review and digital marketing strategy conference calls free of charge! Take advantage of the additional time you have away from live patient care and reinvest in your businesses future by exploring this opportunity today! Click here for more information or contact Tina Cruz at (512) 818-6782 or email tina@rcdigital.us

Patient Care

Telemedicine New Patient Consultations

In response to calls for flexibility and broadening access to telemedicine services during the COVID-19 public health emergency, certain federal privacy regulations have been relaxed and payment policies expanded as a result of actions taken by the Health and Human Services (HHS) Office for Civil Rights (OCR) & the Centers for Medicare & Medicaid Services (CMS). (4) The American Medical Association (AMA) has produced a “quick guide to telemedicine in practice” that you can access by clicking here, in addition, The Center for Medicare and Medicaid Services (CMS) has published a fact sheet that you can view here which expands the type of telemedicine encounters than can be billed for to include Telehealth Visits, Virtual Check In’s, and also E-Visits. A virtual consultation is similar to an in-person consultation, except it’s done digitally, and all you need is a webcam and software (or simply your smartphone). Here are a few different tools to consider:

- Zoom

- Facebook Messenger

- UberConference

- Google Hangouts

- Viber

- FaceTime

*Two other solutions that are telemedicine-focused are:

https://doxy.me/ & https://vsee.com/clinic/

Both are HIPAA compliant.

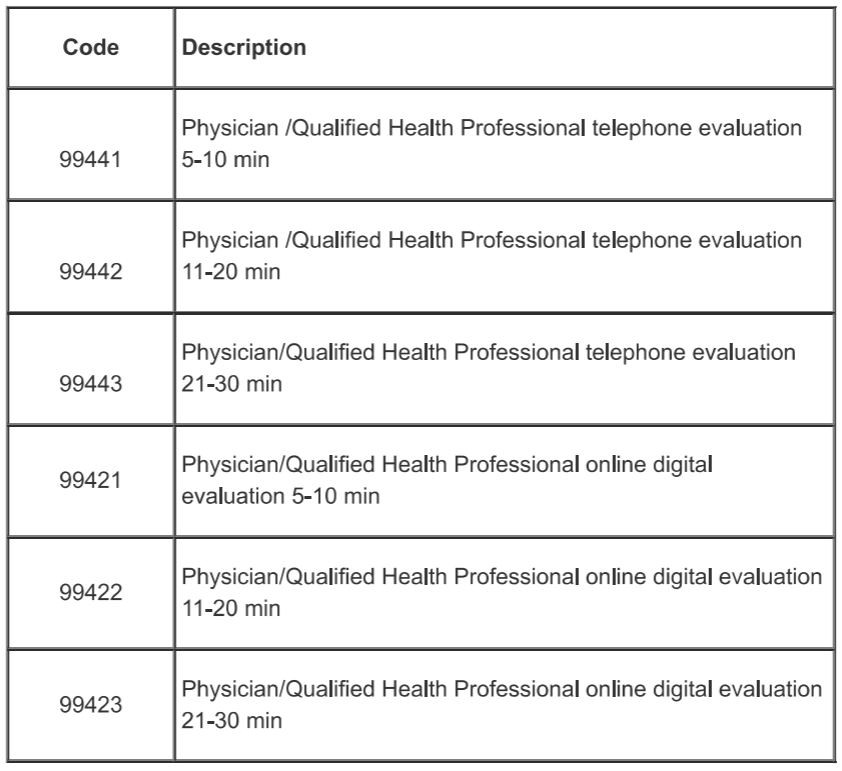

Telehealth CPT Codes

Current Procedural Terminology (CPT) code sets for Telehealth evaluation are as follows:

Patient Care

Telemedicine New Patient Consultations

In response to calls for flexibility and broadening access to telemedicine services during the COVID-19 public health emergency, certain federal privacy regulations have been relaxed and payment policies expanded as a result of actions taken by the Health and Human Services (HHS) Office for Civil Rights (OCR) & the Centers for Medicare & Medicaid Services (CMS). (4) The American Medical Association (AMA) has produced a “quick guide to telemedicine in practice” that you can access by clicking here, in addition, The Center for Medicare and Medicaid Services (CMS) has published a fact sheet that you can view here which expands the type of telemedicine encounters than can be billed for to include Telehealth Visits, Virtual Check In’s, and also E-Visits. A virtual consultation is similar to an in-person consultation, except it’s done digitally, and all you need is a webcam and software (or simply your smartphone). Here are a few different tools to consider:

- Zoom

- Facebook Messenger

- UberConference

- Google Hangouts

- Viber

- FaceTime

*Two other solutions that are telemedicine-focused are:

https://doxy.me/ & https://vsee.com/clinic/

Both are HIPAA compliant.

Telehealth CPT Codes

Current Procedural Terminology (CPT) code sets for Telehealth evaluation are as follows:

You will still need to document your encounter as if it were a face-to-face visit and complete the associated SOAP note thereto. If you require a template for the new patient consultation for Osteoarthritis of the knee or shoulder, or for use with insurance-covered amniotic products please email: info@integrativepracticesolutions.com with your name, contact information, and practice information and we will reply with further details about how we can help.

Patient Financing

During the financial crisis of 2008 we saw a lot of patients that wanted to begin care but honestly could not afford to do so. It is at this time that I began using 3rd party patient financing companies such as Care Credit®, and it helped to solve a problem for both the patient and our practice increasing access to care.

That being said, not everyone that applied was approved and over the years I have tried many different new patient financing companies to increase our approval rate. One of the most effective I have discovered is Patient Payment Solutions (PPS) that operates in a fashion similar to how LendingTree® works for home mortgages, but for patient financing.

Patient Payment Solutions brokers the patient’s application out to a network of 16+ lenders that compete for the business and get you paid upfront for elective procedures, co-insurance, co-pays, and deductibles.

Their normal activation fee of $299 is now discounted to $149, and the first three months service fee of $99 waived in full – save $447!

Offer valid until April 5th, 2020. To view a video of how PPS pre-funding service works please click here.

Insurance Based Regenerative Medicine

With the economic impact of COVID-19 likely to hit most Americans, spending on elective procedures will be more difficult – much like what we experienced in 2008. At that time we had to turn to what I called “the hybrid payment model”, a system by which we accepted as much insurance coverage for each case as possible, bracing, physical therapy, etc. if we could bill for it we did. We then collected the balance of what were non-covered services as self-pay from the patient, but we called it co-insurance, not cash, not elective – we used a term the patient was already familiar with and not afraid of. By offering pre-payment discounts to entice the patient to proceed with care and lowering their out-of-pocket costs by accepting what insurance benefits we could, our close rate increased, our case values improved, and we didn’t just survive 2008 – we thrived again!

Click here to download a FREE copy of our regenerative medicine new patient financing booklet.

Today we have not only the hybrid payment model concept to turn to, but a new alternative to non-covered mesenchymal stem cells and other allograft products, PalinGen® by AmnioTechnology. This amniotic fluid allograft injectable has been FDA registered and assigned the HCPCS code Q4174. As such it is covered for indicated uses by many insurances including Medicare, Tricare, United Healthcare Medicare Replacement Plans, some BCBS and Humana plans, and more! If you are not already utilizing this great tool within your regenerative medical practice, there is no better time to explore this opportunity than when it is needed most, such as during a global economic crisis. To learn more, you may watch a recorded orientation webinar covering this topic by clicking here. To get started you can download the new account paperwork by clicking here and returning via fax to 813-683-9536 or via email to info@integrativepracticesolutions.com.

Telemedicine Physical Therapy

With reduced access to personal protective equipment (PPE) and recommendation of social-distancing, the US Department of Labor has issued new guidelines that allow for expanded use of remote monitoring and telemedicine application for healthcare workers. (5) Beyond patient consultations as discussed earlier, it also possible to perform certain ongoing care such as home exercise protocols without face-to-face encounters with the patient. For our clients treating Osteoarthritis of the Knee we already have a simple home exercise guide that can be downloaded here.

Additionally, for those that have a DMEPOS license to bill Medicare, or for your patients with commercial health insurance that have DME benefits, there is a home-rehab device called the KneeMD that can be delivered to the patients home and billed on a recurring monthly basis utilizing the HCPCS code E1811. This can provide a more formal home therapy protocol and potentially yield greater positive clinical outcomes for your OA cases.

To assist your operational cash flow during this challenging period we are offering a 10% Discount on all KneeMD orders through April 15th. Simply download and fax or email your order using this form and the 10% discount will automatically be applied.

To assist your operational cash flow during this challenging period we are offering a 10% Discount on all KneeMD orders through April 15th. Simply download and fax or email your order using this form and the 10% discount will automatically be applied.

If you are unfamiliar with the KneeMD device, please watch this recorded webinar here for a comprehensive orientation. *The first portion of this recording also covers GenVisc 850, so please fast forward to the 41-minute mark and begin viewing from that point if you are only interested in the KneeMD segment of the recording.

We know the value that physical therapy and home exercise can add to a course of viscosupplementation as documented in this clinical research study published in The Archives of Physical Medicine and Rehabilitation. Don’t let your patients’ clinical progress backslide just because of this quarantine period when there is a way to continue their care in the comfort of their own home self-mitigated with your assistance and supervision remotely.

Juventix Platelet-Rich Plasma (PRP) Special Offer

We are proud to announce our updated and modernized branding and packaging of the Juventix Regenerative Medical line of PRP Kits and products!

We are proud to announce our updated and modernized branding and packaging of the Juventix Regenerative Medical line of PRP Kits and products!

To provide additional economic relief to our clients amid the challenges posed by this global pandemic we are offering the remaining inventory of our original packing at the maximum quantity discount regardless of quantity:

- 12ML2 Medical PRP Kit – $89

- Hyaluronic Acid+PRP Kit – $139

- HG10ML2 Biotin+PRP Kit – $119

- Plasma Bio-Incubator – $1,970

Our redesigned Bio-Incubator – Coming Soon!

Download Juventix PRP Order Form HERE

In closing, I would like to remind our followers reading this article that you are not alone amid this global crisis. It has always been my goal to help independent healthcare clinics to enhance the quality of care through novel treatment concepts, as well as to drive profitability. But during challenging times such as this, that goal is even more relevant and necessary because we cannot help any patients if we are not in business and unable to see them! That’s why I would like to extend the offer should you have any specific questions or concerns at this time please call us at (855) 854-6332 or email: info@integrativepracticesolutions.com

Please stay safe, remain healthy, and maintain hope that we will prevail through this global crisis together and your business can and will survive if you take the right steps to weather this temporary setback and best position yourself and your healthcare business for a post-pandemic recovery!

Sources:

- https://www.fool.com/investing/best-warren-buffett-quotes.aspx

- https://www.washingtonpost.com/business/2020/03/15/federal-reserve-slashes–interest-rates-zero-part-wide-ranging-emergency-intervention/

- https://www.congress.gov/bill/116th-congress/house-bill/6201/text

- https://www.ama-assn.org/delivering-care/public-health/key-changes-made-telehealth-guidelines-boost-covid-19-care

- https://www.osha.gov/SLTC/covid-19/controlprevention.html

About the Author: Lance Liberti is a nationally recognized healthcare consultant and new patient marketing professional with more than a decade of practical experience in the field. His experience spans multiple areas of practice including non-surgical spinal decompression, medically supervised weight loss, aesthetic medicine, and non-operative extremity pain management. The president and CEO of Integrative Practice Solutions, Mr. Liberti specializes in assisting health and wellness professionals to integrate boutique medical services into their practices to offer non-surgical solutions to those suffering from various degenerative musculoskeletal conditions. To learn more about Mr. Liberti’s extensive experience and see examples of his work products view his LinkedIn profile here: https://www.linkedin.com/in/lanceliberti

Legal Disclaimer: The information contained in this article is provided for informational purposes only and should not be construed as legal advice on any subject matter. You should not act or refrain from acting on the basis of any content included in this article without seeking legal or other professional advice. The contents of this article contain general information and may not reflect current legal developments or address your situation. We disclaim all liability for actions you take or fail to take based on any content of this article.