As the close of the year approaches, a crucial window of opportunity emerges for physicians and healthcare clinics to revitalize and enhance their medical practices through the acquisition or upgrading of essential medical equipment. Astutely leveraging available tax incentives, such as the IRS Section 179 deduction and the Section 44 ADA Tax Credit, can dramatically offset the purchase price of new equipment, thereby boosting your business’s operational efficiency and financial health.

IRS Section 179: An Overture to Optimal Tax Savings

The IRS Section 179 deduction is a formidable tax incentive that encourages businesses to invest in equipment and technology. Predominantly, this program allows businesses to deduct the full purchase price of qualifying equipment financed or leased during the tax year. Thus, if you are contemplating the purchase of new medical equipment, leveraging this tax deduction can substantively reduce your business’s net cost, enhance cash flow, and foster a conducive environment for operational advancements.

This impactful incentive allows your healthcare practice to write off up to $1,050,000, with a “total equipment purchased” cap of $2,620,000 for the 2023 year. By effectively navigating this tax-saving conduit, you stand to profoundly benefit by realizing immediate tax savings, thus accelerating your return on investment.

Section 44 ADA: A Gateway to Enhanced Accessibility

The Section 44 ADA Tax Credit further amplifies the financial viability of acquiring or modifying equipment to bolster inclusivity for individuals with disabilities. Specifically, this provision avails a tax credit of up to $10,250 for qualified expenditures incurred in the endeavor to enhance accessibility, such as acquiring or modifying equipment or devices to cater to individuals with disabilities.

By harnessing this tax credit, you underscore a commitment to inclusivity, ensuring that your medical practice resonates with universal accessibility standards. This not only augments your societal impact but also enhances your competitive advantage in the healthcare landscape.

Utilizing Qualified Medical Equipment to Enhance Clinical Outcomes & Profitability

While the Section 179 & 44 tax reduction strategies are powerful tools for modern healthcare clinic owners and operators, it is important to utilize this strategy in a fashion that will not only reduce your tax liability in the current year, but also position your business for rapid growth and enhanced profitability for many years to come!

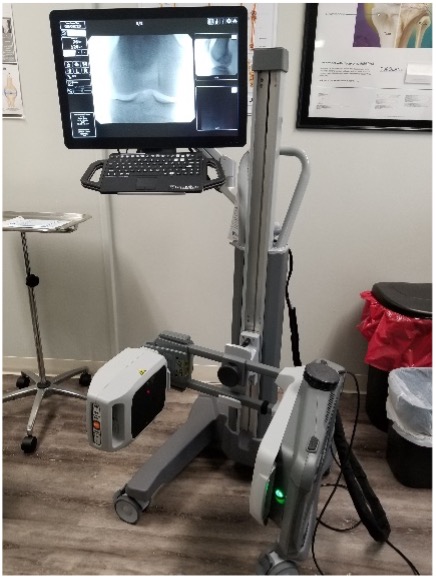

That is why at Integrative Practice Solutions we offer qualified essential medical equipment such as video-fluoroscopes that allow the integration of a proven 92.7% effective1 non-surgical treatment option for those suffering from Osteoarthritis of the knee(s) and shoulder(s) called The Advanced Arthritis Relief Protocol, or AARP Program for short.

While the Section 179 & 44 tax reduction strategies are powerful tools for modern healthcare clinic owners and operators, it is important to utilize this strategy in a fashion that will not only reduce your tax liability in the current year, but also position your business for rapid growth and enhanced profitability for many years to come!

That is why at Integrative Practice Solutions we offer qualified essential medical equipment such as video-fluoroscopes that allow the integration of a proven 92.7% effective1 non-surgical treatment option for those suffering from Osteoarthritis of the knee(s) and shoulder(s) called The Advanced Arthritis Relief Protocol, or AARP Program for short.

Osteoarthritis is the 3rd fastest growing condition in the US (75%), behind only diabetes (135%) and dementia (84%).2 Additionally, two in three people who are obese may develop symptomatic knee OA in their lifetime.3 These factors contribute to the fact that the number of persons with arthritis is expected to reach 67 million in 2030, an increase of 40% from 2005.4 Despite the rapid growth of Osteoarthritis, knee pain, and mobility limiting diseases in our country the standard of care has not evolved as this condition continues to impact millions of Americans each year. Oral NSAIDs, corticosteroid injections, and topical analgesics remain the front-line of care, despite their ineffectiveness and significant risk-factors. When those treatments fail, Total Knee Arthroplasty (TKA), or knee replacement surgery as it is more commonly referred to, is often the next (or last) option. This antiquated approach to the management of Osteoarthritis does not have to be the only option for your patients any longer!

In addition to the substantial clinic benefits achieved with the AARP program, this non-surgical outpatient protocol also produces substantial new patient flow, increased collections, and enhanced profit margins for the healthcare clinic. In fact, most physicians that add the AARP program to their practice add over $2.2 million dollars of new revenue to their practice!5

To schedule a private webinar to review if the AARP program may be right for your practice, as well as allowing you to maximize your Section 179 & Section 44 tax deductions for the year, please book an appointment here: https://integrativepracticesolutions.com/private-webinar-ips/

Another rapidly growing segment of the US Healthcare marketplace is aesthetics and anti-aging. That is why at Juventix Regenerative Medical we developed and manufacture the least-costly, fastest, and easiest to utilize FDA-cleared Platelet-Rich-Plasma (PRP) processing devices in the world.

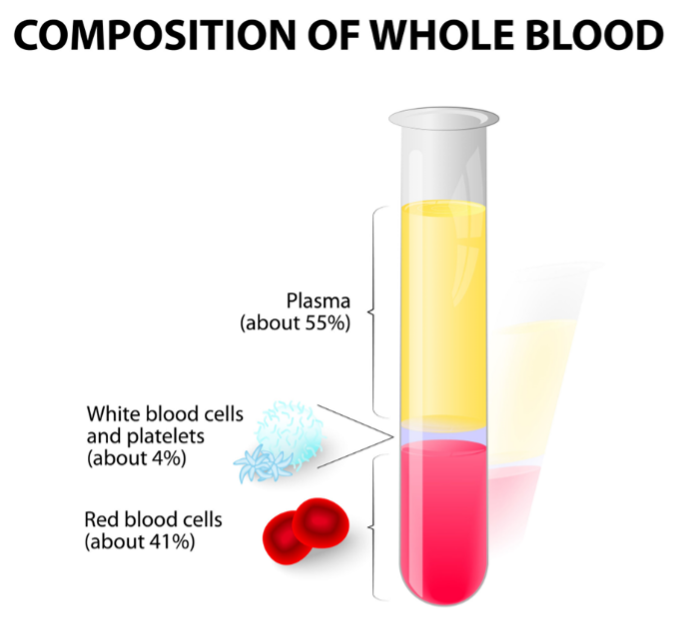

The Aesthetic Society reports more than $19-Billion is spent on surgical and non-surgical aesthetic procedures in the USA currently with non-surgical growth significantly outpacing surgical spending! Patients are actively looking for drug-free, non-surgical alternatives to facial fillers and cosmetic surgical procedures. PRP offers a safe and effective autologous (“from your own body”) treatment option. PRP is a component of your blood (plasma) with concentrations of platelets above normal values. PRP typically contains 3-8 times the concentration of normal platelet levels. PRP contains several different growth factors and other cytokines that can stimulate healing of soft tissue such as muscles, ligaments, tendons, & skin, as well as to treat conditions such as Erectile Dysfunction (ED) and hair loss associated with androgenic alopecia, telogen effluvium (TE), and more!

The equipment required to add Platelet-Rich-Plasma (PRP) to your practice is inexpensive and easy to use. This represents a simply way to take advantage of Section 179 & Section 44 tax deductions in your practice without substantial risk. To learn more about adding PRP to your practice please call (866) 693-4777, email: hello@juventix.com, or complete the contact form located here: https://juventix.com/contact-us/

Strategic Equipment Investments to Propel Your Practice Forward

In the strategic calculus of your business operations, aligning your year-end equipment investment decisions with the lucrative tax benefits encapsulated in the IRS Section 179 and the Section 44 ADA Tax Credit stands as a monumental strategy. This synergy not only offsets your equipment acquisition costs but also escalates your practice’s operational acumen, inclusivity, and overall competitive standing.

Let these potent tax incentives illuminate the pathway to optimizing your practice’s performance and societal impact. Make the informed decision to leverage these benefits as you strategize your year-end medical equipment investments and unlock unprecedented value for your healthcare practice!

To discuss adding qualified essential medical equipment from Integrative Practice Solutions and Juventix Regenerative Medical to your healthcare clinic please call toll free 855-854-6332, schedule an appointment to meet via Zoom here: https://ipswebinar.as.me/schedule.php or email: hello@juventix.com

About the Author: Lance Liberti is a nationally recognized healthcare consultant and new patient marketing professional with more than two decades of practical experience in the field. His experience spans multiple areas of practice including non-surgical spinal decompression, medically supervised weight loss, aesthetic medicine, and non-operative extremity pain management. The president and CEO of Integrative Practice Solutions and Juventix Regenerative Medical Mr. Liberti specializes in assisting health and wellness professionals integrate boutique medical services into their practices to offer non-surgical solutions to those suffering from various degenerative musculoskeletal conditions. To learn more about Mr. Liberti’s extensive experience and see examples of his work products view his LinkedIn profile here: https://www.linkedin.com/in/lanceliberti

Sources:

- https://integrativepracticesolutions.com/wp-content/uploads/2020/03/Physicians-Rehab-Summary-of-Hyalgan-Study.pdf

- https://www.oarsi.org/sites/default/files/docs/2016/oarsi_white_paper_oa_serious_disease_121416_1.pdf

- Arthritis Rheum 2008;59(9):1207–1213. abstract [Data Source: 1999-2003 Johnston County Osteoarthritis Project data]

- Helmick CG, Felson DT, Lawrence RC, et al. Estimates of the prevalence of arthritis and other rheumatic conditions in the United States, part I and part II. Arthritis Rheum. 2008;58:15-35.

- https://integrativepracticesolutions.com/wp-content/uploads/2020/03/OA-Revenue-Projections.pdf

Legal Disclaimer: The information contained in this article is provided for informational purposes only and should not be construed as medical or legal advice on any subject matter. You should not act or refrain from acting on the basis of any content included in this article without seeking medical, legal or other professional advice. The contents of this site contain general information and may not reflect current legal developments or address your situation. We disclaim all liability for actions you take or fail to take based on any content of this article.