Unlock Your Earnings Potential with Year-End Medical Equipment Purchases:

As 2025 draws to a close, a crucial window of opportunity emerges for physicians and healthcare clinics to upgrade or expand essential medical equipment while maximizing available tax incentives. By strategically leveraging the expanded IRS Section 179 deduction, newly restored 100% bonus depreciation, and the Section 44 ADA Tax Credit, practices can dramatically reduce the effective cost of new equipment acquisitions, improving both operational efficiency and financial performance.

IRS Section 179: An Overture to Optimal Tax Savings

The One Big Beautiful Bill Act (OBBBA), enacted in early 2025, significantly expanded the Section 179 deduction and investment caps, providing unprecedented flexibility for small and medium-sized healthcare practices:

- Maximum deduction: Up to $2.5 million for qualifying property placed into service during 2025.

- Phase-out threshold: Begins once total qualifying purchases exceed $4 million and phases out completely above $6.5 million.

- Bonus depreciation: Restored to 100% for qualifying property placed into service after January 19, 2025, and applied after Section 179 limits are reached.

How it works: Section 179 allows practices to expense the full cost of qualifying equipment in the year it is placed into service, instead of depreciating over multiple years. This delivers immediate tax savings while improving cash flow.

This mechanism allows clinics to reinvest in growth and capture significant savings while benefiting from historically favorable borrowing costs following recent Fed interest rate cuts.

Section 44 ADA: A Gateway to Enhanced Accessibility

The Section 44 ADA Tax Credit amplifies the financial benefit of medical equipment purchases by rewarding investments in accessibility. This credit offers up to $10,250 for qualified expenditures to improve accessibility for individuals with disabilities, such as equipment modifications or purchases designed to enhance inclusivity.

By utilizing this credit, practices not only offset costs but also demonstrate a commitment to accessibility and patient-centered care, strengthening their competitive advantage.

Utilizing Qualified Medical Equipment to Enhance Outcomes & Profitability

At Integrative Practice Solutions (IPS), we provide revenue-generating medical equipment solutions such as video-fluoroscopes that support the Advanced Arthritis Relief Protocol (AARP). This evidence-based, non-surgical treatment for osteoarthritis has a documented 92.7% effectiveness rate and empowers clinics to treat one of the fastest-growing conditions in the U.S.

- Osteoarthritis cases are projected to reach 67 million by 2030.

- Physicians who adopt the AARP program often generate over $2.2 million in new annual revenue while improving outcomes for their patients.

Adding this program not only improves care but positions clinics for rapid growth while capturing the full benefit of Section 179 and ADA incentives.

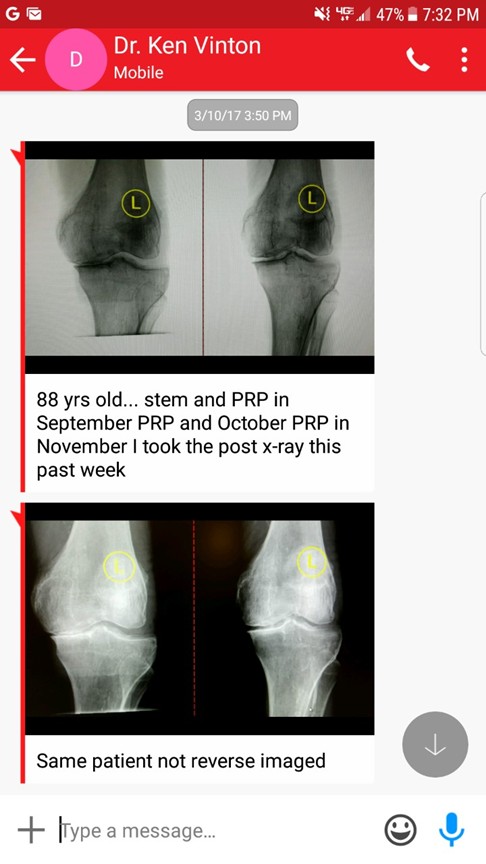

Advancing Orthopedic Care with PRP

In partnership with Juventix Regenerative Medical, we provide access to the most cost-effective, FDA-cleared Platelet-Rich Plasma (PRP) devices available today. PRP has rapidly emerged as a cornerstone in regenerative orthopedics, offering a natural, autologous therapy that leverages a patient’s own blood components to promote tissue healing and reduce inflammation.

One of the most impactful applications is in the treatment of osteoarthritis of the knee, where PRP injections have been shown to:

- Improve joint function

- Reduce pain and stiffness

- Delay or reduce the need for surgical intervention

Beyond the knee, PRP demonstrates broad utility across orthopedic conditions, including tendon injuries, ligament sprains, and cartilage degeneration. For practices, integrating PRP not only provides patients with an evidence-supported, minimally invasive option but also creates a reliable cash-based service line independent of insurance reimbursement barriers.

As the burden of musculoskeletal disease continues to rise, PRP represents an accessible, clinically validated, and profitable solution for practices seeking to expand into regenerative medicine and deliver improved outcomes for patients with chronic orthopedic conditions.

Strategic Equipment Investments to Propel Your Practice Forward

The synergy of lower borrowing costs, expanded Section 179 deductions, 100% bonus depreciation, and the ADA Tax Credit creates one of the most advantageous climates in recent memory for equipment investment. By acting before year-end, practices can:

- Substantially reduce tax liability

- Acquire essential medical equipment at a lower effective cost

- Enhance inclusivity and patient satisfaction

- Drive both clinical excellence and sustained profitability

Call us toll-free: 855-854-6332

Schedule a private webinar: https://ipswebinar.as.me/OA-webinar

Email: info@integrativepracticesolutions.com

About the Author:Lance Liberti is a nationally recognized healthcare consultant and the president and CEO of Integrative Practice Solutions and Juventix Regenerative Medical. With over two decades of experience in medical business development, he specializes in helping healthcare professionals integrate regenerative medicine and non-surgical solutions into their practices.

Legal Disclaimer: The information contained in this article is provided for informational purposes only and should not be construed as medical or legal advice on any subject matter. You should not act or refrain from acting on the basis of any content included in this article without seeking medical, legal or other professional advice. The contents of this site contain general information and may not reflect current legal developments or address your situation. We disclaim all liability for actions you take or fail to take based on any content of this article.